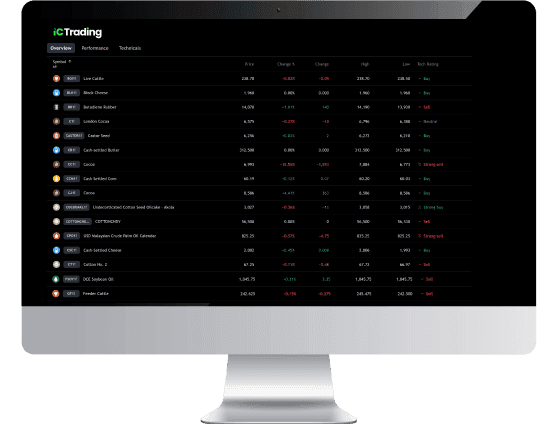

Trade metals, energy, and more

Trading commodities, like metals, energy, and agricultural products, offers opportunities to profit from price changes. You can also trade them against major currencies. Understanding market trends, supply and demand, and price fluctuations is key. Most trading happens through futures contracts or direct exchanges.

22

Commodities

0.0

Tight spreads

1:500

Leverage

40ms

Execution speed

How news impact commodities?

Major news and economic changes significantly impact commodities trading by affecting supply and demand. Events such as natural disasters, geopolitical tensions, or policy shifts can disrupt the production and distribution of commodities like oil, gold, and agricultural products, leading to price volatility. Economic indicators, including interest rate decisions, inflation reports, and GDP data, also influence commodity prices by shaping market sentiment.

Gold, in particular, is often seen as a safe haven during times of economic uncertainty or market turmoil. When currencies depreciate or inflation rises, investors tend to buy gold to preserve value, driving up demand and prices. Traders closely monitor these factors to adjust their strategies and capitalise on market movements.

Commodity trading example

The gross profit on your trade is calculated as follows:

Opening Price

$435.25 * 100 contracts * 4 = USD $174,100

Closing Price

$460 * 100 contracts * 4 = USD $184,000

Gross Profit on Trade

USD $184,000 - $174,100 = $9,900

Opening the Position

Wheat_N7 is currently trading at 434.00/435.25 and you are expecting Australia’s East Coast crops to be affected by adverse weather patterns over the coming year which will result in lower than average crop yields.

You buy 100 contracts of Wheat (4 bushels per contract) at 435.25 which equals USD $174,100 (435.25 * 100 * 4).(4 bushels per contract) at 435.25 which equals USD $174,100 (435.25 * 100 * 4).

Closing the Position

Your research surrounding weather conditions turns out to be correct. Lower crop yields this year have caused Wheat prices to increase to 460.00/462.15. You exit your position by selling your contracts at 460.

You have made $9,900 in profit.

Looking to trade Commodities?

Open an AccountCommodities Conditions

Need more info? Visit our Help Centre page.